China is a leader in the global investment market and soon be the world’s largest startup ecosystem. Don’t think about Silicon Valley anymore, from now on billions are made in China.

- In 2016, the Chinese Venture Capital market got equal to the USA one: $50 billion

- In 2018, Venture investment in China reached $93.8 billion

- In 2017, China was accounting for over 36% of global VC investments

- INSEAD reported that China should dominate the global VC market by 2019-2020

- According to 28% of startup presents in China, investors are more selective than before

- 51% of startup companies expect Venture Capital to be their new source of capital

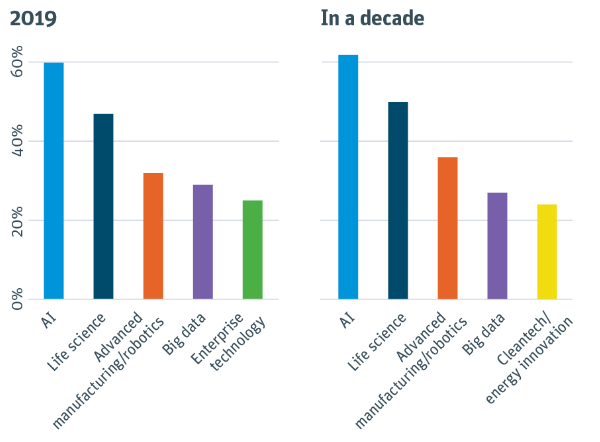

Most promising sectors in the innovation economy:

There are many opportunities to raise fund in China, and it goes through different types of investors:

- Incubators

- Business Angel

- Venture Capital

- Equity fund

- IPO

So, from now the real question is:

According to your project, what kind of investor is made for you?

Startup Incubators

What is it?

A startup incubator is basically an organization supporting new ventures during the project development, providing services such as:

- Infrastructure

- Fund

- Business-related services

- Help for MVP development

In theory, if you just need help or a structure to establish your business, no proven performance will be required. But in real life, there’s such a strong competition to get accepted that you’d better have results to show off.

If you’re also looking for fund, showing performance records will be mandatory. They can offer you capital funding in exchange for equity in your business (around 10% in general).

You can be incubated from a few months to several years.

Pros of Incubators:

- Mentorship: you can get access to advise and guidance

- Investment: they can offer you direct and reliable investment sources from VC, business angels, or private funds

- Credibility: Being accepted in an incubator is a strong sign of credibility and will boost your visibility in China

Cons of Incubators:

- Strong competition: The best incubators only accept 1 to 2% of applicants

- Quality: Some offer great value guidance, but others offer a fast track to the startup graveyard

- Expensive: you may get low capital investment in exchange for business equity, which is an expensive trade…

What kind of companies is it for?

For any startup company having an innovative project or a very high growth potential.

Business Angels

What is it?

Business Angels are usually wealthy individuals offering capital to early-stage startups in exchange for an equity share in the business. Most of BA pair financial motives with a philanthropic bent. They financially support you but also give you access advice according to their field of expertise.

In most cases, to really make money and be sure to get important ROI, they’ll need you to sell your company or to go public.

Business Angels in China:

There is currently more and more BA in China due to the rise of successful and wealthy entrepreneurs. Many of these private BA operate independently and look for investments in business sectors they are experienced in.

Example: Baidu, Ctrip, and Sohu come from Venture Capital and Business Angels Investments.

Pros of Business Angels:

- They take risks: BAs are custom to invest money on risky projects, at least more than regular investors. So, if you need someone to give you a chance, business angels may be the ones to supply the capital.

- Flexible: They’re used to be flexible on the investment terms for the benefit of both parties.

- Experience: the best business angels are mostly former entrepreneurs and will bring their own expertise/experience to the table.

- Quick decisions: as there’s most of the time only one investor, angels can make investment decisions very quickly.

Cons of Business Angels:

- Expensive: as they’ll ask for an equity share in your early-stage development, it can represent a high cost for your company.

- All BA are not the same: Some angels may try to take advantage of naïve funder… Some have great experience and will do their best to help you, some won’t.

- Investment capacity may be limited: even if you get funded, you may get less than with VC funds. At some point, you may outgrow their support.

- They ask a lot from you: early-stage investments may be risky and the only way to secure your company if to offer a big return on investment.

Example of top 6 Business Angels in China:

- Kaifu Lee: a startup Guru and strong believer in AI technology

- Xu Xiaoping: creator of the largest provider of private educational services in China. He focuses mainly on Gaming investment, online education, e-commerce, and mobile internet.

- Cai Wensheng: made a fortune through the internet. Invest mainly in entertainment and internet services.

- Xue Manzi: a Chinese-American billionaire. Invest in mobile internet, healthcare, fintech, education and entertainment industry.

- Lei Jun: Founder of Xiaomi. Mainly invest in IT projects

- Shen Nanpeng: the co-founder of the Chinese Ctrip. Mainly invest in IT, internet services, App

What kind of companies is it for?

A company with important growth potential. All industries are possible, depending on the business angels’ expertise.

Example:

IDEA

An educational and business platform operating within the “Belt & Road” initiative.

They raised investment in China from business angels in 2 rounds. A first round from a private investor of 20,000RMB and a second round from business angels of 8 million RMB.

Venture Capital

What is it?

Venture Capital invests money through funds: a lot of money is gathered by the company’s own investors and the fund’s managers.

A VC will invest money in promising startups and generate ROI for both themselves and their investors. They mostly exchange capital for equity and will try to develop the project as much as possible before selling it to generate important returns.

The size of their fund will determine the size of the expected return on investment. Therefore, it will impact the invested amount, but also the type of companies they’ll invest in.

Pros of VC:

- Strong experience: they want your success and will give you all the guidance and advice required for that.

- Important capital: They have more investment capacities than Business Angels

- Big network: they offer strong credibility, social proof, and access to their personal network.

- Long run: they target big results, so they may help you to raise subsequent rounds of funding

Cons of VC:

- Expect big results: they do a risky business, and expect, therefore, an important return on investment.

- Control: they need to justify their investments, so be sure they’ll ask for board seats.

- Need time to trust you: they need a proven performance in the long run, so they might be on your back for quite a long time.

- Conflict of interests: What you want may be different than what they want for your company’s future…

What kind of companies is it for?

For any innovative startup able to show impressive results and forecasts. They can invest a lot of money in your business but will expect an important return on investment.

Example:

OPAY

A Nigerian Fintech company operating in mobile finance raised two rounds of investments. A first round of $50 million from the Norwegian browser company “Opera”, and a second round of $120 million from Chinese investors such as Meituan-Dianping and others.

Equity Fund

What is it?

It corresponds to crowdfunding, a model allowing people to pre-purchase goods and services, in exchange for rewards. People invest small amounts of capital in a company in exchange for a small share in equity.

Most crowdfunding platforms give a chance to anyone to invest, but there are also some platforms targeting business angels and VCs. Providing, in that case, hybrid funding which combines experts’ experience and individual funds.

To make money, they’ll mostly wait to sell their shares in case of a merger, acquisition, or even IPO.

Pros of Equity fund:

- You set up your own terms: you can choose to raise what you want, and how you want. Giving you more control.

- It’s fast: usually for a good project, it may take 30 to 60 days to raise funds.

- Accessible: You can easily find crowdfunding platforms.

- A new evolution: it may not be as sexy as VC, but it’s definitely easier and offer more flexibility to raise capital.

Cons of Equity fund:

- Restricted capital: there are strict regulations concerning crowdfunding. You have a limited number of investors and a limited amount of capital that you can raise.

- Careful to hidden fees: there is a high chance for you to discover fees for the facilitation and payment process. Fees that might be small but can add up very quickly.

- Lack of guidance: You’ll basically be on your own, so nobody on your back to tell you what to do. But in business, expert advice can be very valuable.

What kind of companies is it for?

For any company and any type of industry. You’ll trade shares in your business in exchange for public small investments. So, basically, your only concern will be to convince people to invest in your project. If it’s appealing, anybody could fund you.

IPO (Initial Public Offering)

What is it?

Once a company starts growing, at a point it will reach its peak. And to continue its growth, the company will require serious injections of capital. So much that sometimes even VCs can’t contribute to all of it by themselves. That’s at this exact moment, that company will ask for Initial Public Offering and transform itself into an organization in which anyone can invest.

Commonly called a stock market launch, it turns the company from a private one to a public one. They sell a portion of shares of the company on the public stock exchange market.

Pros of an IPO:

- Massive fund: An IPO can raise billions of dollars.

- Liquidity: With an IPO, founders and investors can sell their shares, and free up liquid capital for the company’s growth.

- Attractive: with such a model you can offer stock options to any valuable talent or collaborator. The best talents in the world will work for you.

- A real success: Hitting an IPO is the ultimate goal for many companies. A real proof of success.

Cons of an IPO:

- Expensive: it costs on average around $3.7 million to launch an IPO, and it needs a lot of commitments. The estimated cost per year to operate as a public company is around $1.5 million.

- No more control: in most Public companies, there are over thousands of shareholders. Performance needs to be reported, and poor ones will need to be answered.

- Not a startup anymore: at this stage, you’ll have a very different job than the one of a startup founder.

What kind of companies is it for?

Very experienced and successful startups. The kind of company that already got several rounds of investments has a hundred million of revenue every year, an incredible growth rate, and planning to raise not less than hundreds of millions of dollars, even billions.

For more information about raising funds in China.

Other success stories in China.

QUNAR

One of Ctrip’s rivals. They started the company in 2005 making the company a Chinese online travel giant despite its lack of local expertise.

They raised over $306 million in investment from Baidu and led the company to an IPO on the NASDAQ in 2013.

MEI.COM

A French company offering the first luxury goods flash-sales site in 2009. By the end of 2016, they already had over 10 million members.

The company got funded by Alibaba Group Holding Ltd, which invested more than $100 million.

What is your next step?

If you have any questions about choosing the right Chinese investors, do not hesitate to contact us.

We offer you a 30min free call.

We are GMA

- Digital Marketing Expert

- Professional in investment raising in China

- We understand your target and can assist you

6 comments

NANDINE RAMKUMAR

LOOKING FOR A CHINESE PARTNER TO COMMENCE A PROJECT

Olivier VEROT

Hello

Send an email, please. Better to have a good project and serious Pitch desk

maybe wang

Amazing Article, Thank You For Sharing us! I will be reading your article.

maybe wang

Amazing Article, Thank You For Sharing us! I will be reading your article.

AYODELE

I’m mandate from Nigeria and I need Chinese investors and technical partners for my proposed project in selected States Governments respectively in Nigeria.

Olivier

what is your website?