It comes as no surprise today that Chinese consumers are a big driver of the Luxury Market growth.

And if it was you clearly haven’t watched Crazy Rich Asians!

According to Bain & Company, the Chinese should account for around half of the worldwide luxury consumption in 2025. China is evolving fast; and even the lower-tier cities are booming.

The potential audience for the luxury sector became even wider and you have to understand the preferences, habits, and expectations of Chinese luxury consumers.

Contents

- 1 Quick Summary

- 2 China is the Best Country to Sell Luxury Goods

- 3 Chinese Luxury Consumers: an Opportunity for International Brands

- 4 What are the Most Profitable Luxury Sectors in China?

- 5 How to Market Your Luxury Brand in China

- 5.1 To sell luxury goods in China there is a need for strong branding

- 5.2 Localize your marketing campaigns for the Chinese market

- 5.3 Focus on building a positive e-reputation on the Chinese Internet

- 5.4 Gain exposure through Chinese social media

- 5.5 Luxury brands should collaborate with Chinese KOLs

- 5.6 Luxury and e-commerce are tightly linked in China

- 6 About us: The Best Mareting Agency for Luxury Brands in China

Quick Summary

- Rapid Growth of China’s Luxury Market: China is projected to account for about half of the worldwide luxury consumption by 2025, driven by its fast-evolving economy, the rise of the middle class, and booming lower-tier cities.

- Middle-Class Expansion: China’s middle class, which represented 57% of the economy in 2015, is expected to reach 75% by 2030, indicating a growing audience for luxury goods, particularly in fashion and jewelry.

- Rise of Lower-Tier Cities: Economic growth has led to the development of lower-tier cities, where Gen Z’s high disposable income is contributing significantly to the luxury market through social marketplaces and e-commerce platforms.

- Online and Offline Shopping Integration: The concept of “New Retail” in China highlights the interdependence of online and offline shopping, with 80% of Chinese consumers preferring to buy luxury goods online.

- Emergence of Local Chinese Luxury Brands: Local brands are increasingly competing in the luxury market, leveraging their deep understanding of Chinese consumers and cultural nuances.

- Increasing Wealth and Luxury Lifestyle: With China ranking second in the billionaires count, there’s a significant increase in wealth, leading to a quest for luxury lifestyles that symbolize prestige, social status, and accumulated wealth.

- Focus on Women and Millennials: Empowered and independent Chinese women, along with Millennials, are key segments driving luxury consumption, emphasizing the need for brands to engage with these demographics through social media and community recommendations.

- Gen Z’s Influence: Generation Z, open to new trends and shopping habits, is changing the face of luxury consumption with their concerns for sustainability and social impact.

- Profitable Luxury Sectors: The most profitable luxury sectors in China include fashion, bags & leather goods, jewelry & watches, fragrances & cosmetics, premium wines & spirits, luxury cars & yachts, and luxury tourism.

- Marketing Strategies for Success: To succeed in China’s luxury market, brands need to focus on strong branding, localized marketing campaigns, and building a positive e-reputation, catering to the unique preferences and cultural sensitivities of Chinese consumers.

China is the Best Country to Sell Luxury Goods

In the Western mind, China is a land of opportunities. People are looking for the trendiest brand in Europe, the last best-selling luxury bag, and the last trend to catch on. In China, the figures are totally crazy and overpass anyone’s dream.

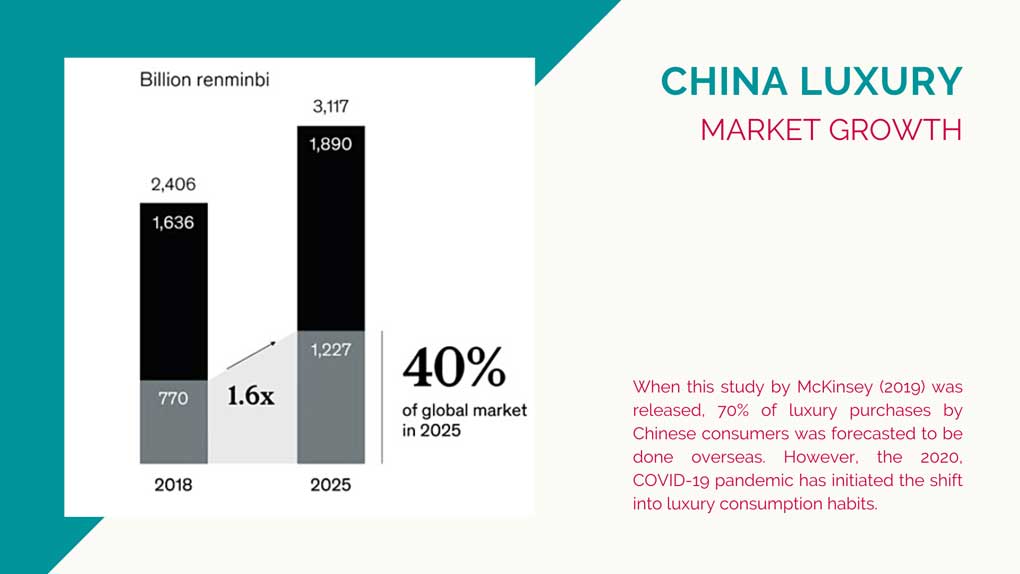

A shift in luxury consumption habits in China

Since the majority of luxury sales will be generated in China in the coming years, luxury brands are taking care of their Chinese consumers. Today, luxury brands cannot neglect their Asian audience if they want to maintain growth. During the Covid-19 pandemic, many brands from the luxury sector maintained sales thanks to Chinese luxury consumers.

How do Chinese consumers purchase then? Chinese luxury consumers used to travel a lot to benefit from low taxes in duty-free shops and unique client service. Due to Covid-19 international travel restrictions, they switched from overseas purchases to domestic purchases.

Any luxury brand looking to perform in China needs to seduce and attract Chinese consumers there. To do so, it is essential to understand Chinese culture and national pride.

China’s middle-class expansion

Chinese customers who can afford luxury products are growing. In 2015, China’s middle class represented 57% of the economy, which was already more than half. They are expected to reach 75% by 2030. These figures indicate that there will be no slowdown in this market as the Chinese avidly embrace a new lifestyle and new consumption habits.

According to a recent survey, the majority of Chinese luxury consumers are going to favor fashion and jewelry over leather goods or bags. These two categories will drive the expansion and growth rate of the personal luxury goods market in China.

More and more Chinese consumers will show interest in the luxury sector and affordable luxury goods market, as their purchasing power is growing. Having a low-price entry point in a luxury assortment is key to targeting these newcomers with disposable income in the luxury market. It is essential to target, seduce, and engage with them to build a strong audience in the future.

The rise of Chinese lower-tier cities

Constant economic growth favored the development of lower-tier cities in China. Luxury brands used to head towards Shanghai, Beijing, Guangzhou, etc… The first-tier cities were swamped by luxury online and offline stores, popups, and events. While the lower-tier cities were taken out of the picture with limited access to luxury brands and luxury products unless they travel to Shanghai or Beijing.

Gen Z from Tier 2, 3, and 4 cities will contribute a lot to the luxury market through social marketplaces and e-commerce platforms. Young people in these lower-tier cities are often the only child in their families and benefit from a high revenue to upgrade their consumption of luxury products.

Combination of online and offline shopping

Digital is everywhere in China. Alibaba Group even created the term “New Retail” to designate how online and offline are becoming interdependent to offer a unique experience to Chinese consumers. Only 4% of Chinese e-commerce customers will have an “offline only” purchasing journey.

Basically, they search for information online, interact with the luxury brand through social media and purchase the product online or offline. The Chinese Gen Z favours integrated e-commerce platforms and online channels to do their shopping.

Today, 80% of the Chinese consumers prefer to buy online when it comes to luxury goods market. All the luxury brands understood this well and decided to set up online flagship stores, live streaming sessions, online and offline events, gaming, etc. The boundaries do not exist anymore between you and your client in Asia.

Chinese Luxury Consumers: an Opportunity for International Brands

There are more and more local Chinese luxury brands emerging across different categories to take on China’s luxury market. What is their main asset? They know everything about China and the Chinese luxury shoppers. They have figured everything out while international brands are still trying to get it right.

Fast growing wealth

China is the second country in the billionaires ranking, accounting for 607 billionaires, right after US with 735 billionaires. When we talk about an increase in wealth among Chinese people, we do not talk about a couple of RMB, we talk about hundreds or thousands of dollars that are ready to be spent on luxury goods.

According to Equité, 400 million additional Chinese will have the means to purchase personal luxury goods in the next 20 years. This evolution is key for luxury brands. It is more than the total population of the US, having all the financial stability to drive luxury consumption growth in each and every category.

Quest for a luxury lifestyle to “show off”

In China, the cultural concept of “Mianzi” is essential to understanding the consumption of personal luxury goods. The term mianzi literally means “face”. In other words, it is essential for any Chinese to keep his/her face and his/her honour in any situation (you are also supposed to be giving face). This is tightly linked to reputation and prestige in Asia.

Purchasing luxury goods is a symbol of prestige, social status and accumulated wealth. The more you take care of your appearance and lifestyle, the more you show to the world you succeeded.

In the coming years, we should see a shift from a way to show off to personal pleasure. The purchasing factors for the Chinese luxury consumers are now well-being, happiness, and experience. They will probably no longer want to own a luxury item for the sake of it but look for a unique experience and social impact.

Target empowered and independents women

Chinese women are spending more than ever before. They represent a significant segment of luxury consumption. The main structural change that occurred is the higher education and greater participation of Chinese women in the workforce in recent years.

Today, they have the financial autonomy to support their purchasing power. By comparison, more than half (56%) of women completed secondary school compared to 46% of men. For the luxury goods market, the modern Chinese woman is key to making the luxury consumption growth rate rocket.

Chinese independent women are particularly sensitive to brand reputation and storytelling. Their shopping habits are very similar; they go through social media, recommendations from the community, discussions with friends, content, and products comparison to motivate their purchases.

But reputation is different from mass recognition. They are looking for niche brands with distinctive styles rather than global giants to act like everyone else. Understand your target and make a difference.

Engage with Chinese Millenials

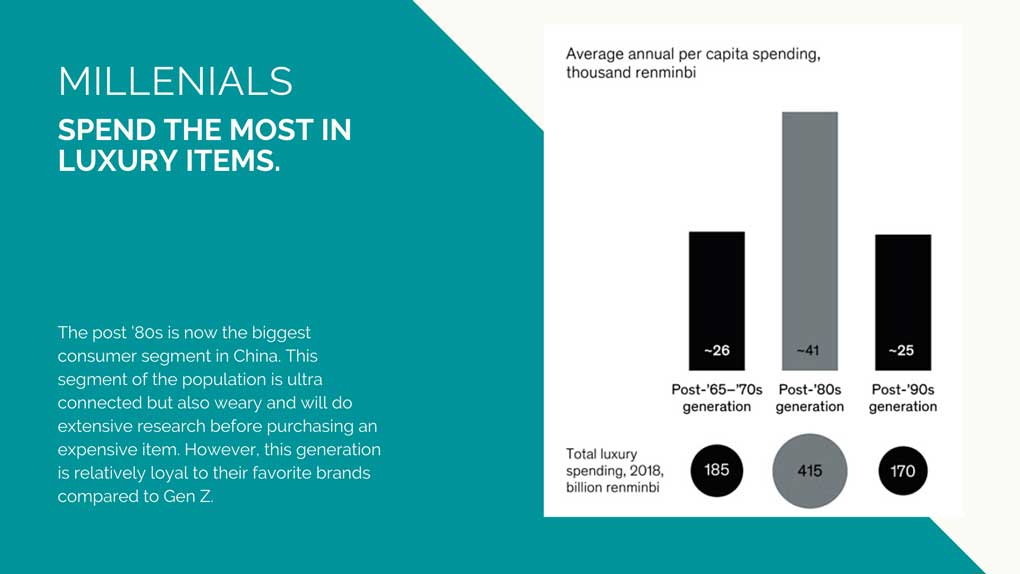

Born between 1980 – 1995, Millennials are the leading force in the luxury goods market in China. According to a recent survey, they should account for 40% of global luxury sales by 2024. They represent the largest Chinese consumer group with over 350 million people. Millennials are driving the digital explosion in China through live streaming and disruptive content.

Chinese Millennials are sensitive to luxury brands’ content and experience. They expect inspiring stories and insightful official accounts to engage with. International brands often make the mistake to use their social media to sell and collect customer data rather than to engage in discussion.

Millennials rely on community recommendations and word-of-mouth. They will always favour a retail brand they can interact with over a sophisticated luxury goods brand that remains distant. Any luxury brand should favour WeChat, Weibo, Little Red Book, Douyin, live streaming, and mobile games to engage with Chinese Millennials.

Seduce the Chinese Gen Z

Born between 1996 – 2010, Generation Z is the generation most open to new trends and shopping habits coming from Europe and the US. They are always looking for new, disruptive, and imported luxury goods. With new concerns and expectations after the pandemic, Gen Z is changing the face of luxury consumption. They are the first group to stand out against animal testing, fur, negative impact on the environment etc.

According to McKinsey, the Chinese Gen Z will account for 20% of the total spending growth in China by 2030. It is essential for luxury companies to understand their opinions and expectations to avoid any backlash.

They love to discover new luxury brands, try new products, and purchase the same luxury goods as celebrities and KOLs. The best strategy to target the Chinese Gen Z is to select KOLs and KOCs to promote your brand to Chinese luxury consumers.

What are the Most Profitable Luxury Sectors in China?

In the world of luxury goods, each segment is facing its own opportunities and challenges. Each luxury sector is thriving with a strong growth rate and solid customer base.

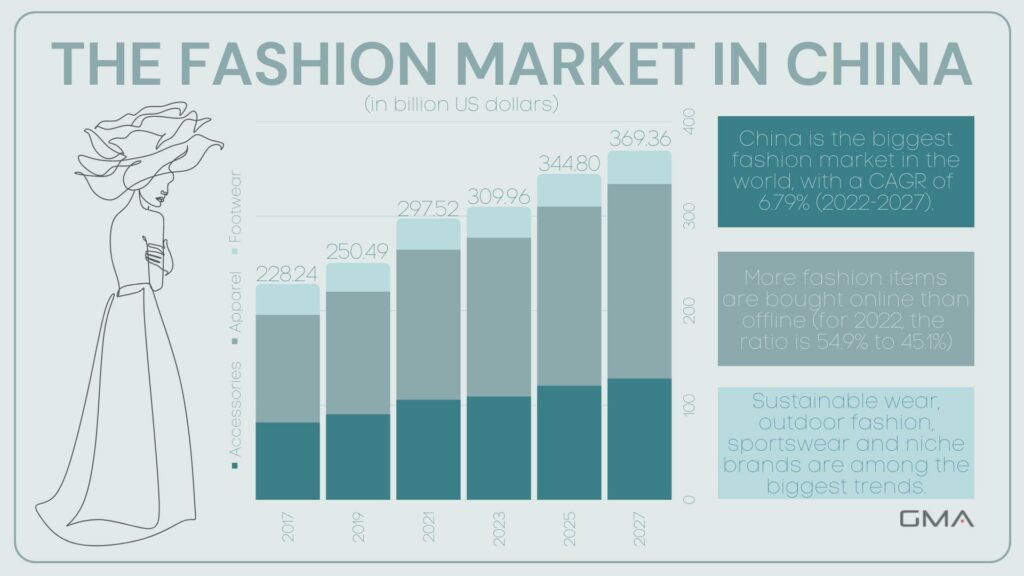

The luxury fashion market in China

In China, the annual revenue of luxury fashion reached 10.54 billion USD in 2023 and is expected to grow up to 13.31 billion USD by 2028. The annual growth rate of the market is expected to be +6% for the coming years.

In 2023, the face of luxury fashion will evolve. China is entering the era of secondhand with dedicated mobile apps like Plum and influencers’ endorsements. The top KOL Viya shared with her community her last purchase of a secondhand luxury bag saying, “who will see the difference between a brand new Louis Vuitton bag and a secondhand one”.

Chinese Gen Z and Millennials are more sensitive to the impact of the fashion industry on the planet and look after new shopping habits. Secondhand is definitely a trend to watch.

Today, people want to differentiate by their consumption. For the average Chinese luxury shopper, purchasing a Chanel tweed jacket is not enough to differentiate from 1.4 billion people anymore. You need to have a unique style and be ahead of trends. The key is now to “mix and match” their style by incorporating fashion into luxury, which explains the success of Off White in China.

Luxury bags & leather goods

The annual revenue of luxury leather goods in China is expected to reach 9 billion USD in 2023. The market is expected to grow by an annual rate of 7%. The top 5 bags and leather goods brands are Hermès, Chanel, Louis Vuitton, Gucci, and Dior.

By far, Hermès has the most important brand awareness for the leather goods category. This is mainly due to the unique item design and brand reputation in China. For Chinese consumers, design and materials are the main information they are interested in, but design and brand will finally affect their decision.

68% of Chinese shoppers purchase at least a handbag once a season. Even 36% purchase a new bag per season. You definitely need to anticipate the tastes and expectations of Chinese handbag lovers to seduce and engage with them.

In the meantime, you definitely need to look after the trend of Chinese nicknames. Especially for bags and cosmetics, the Chinese give nicknames based on pop culture, translation, or overall design to talk about a specific item.

The majority of Chinese can encounter difficulties saying an international name. So, they come up with the original nicknames on Weibo or WeChat. For instance, the famous Longchamp bag called “Le Pliage” is named “The Dumpling Bag” in China. Any luxury brand needs to stay aware of these Chinese cultural habits and could turn this trend into a key marketing strategy.

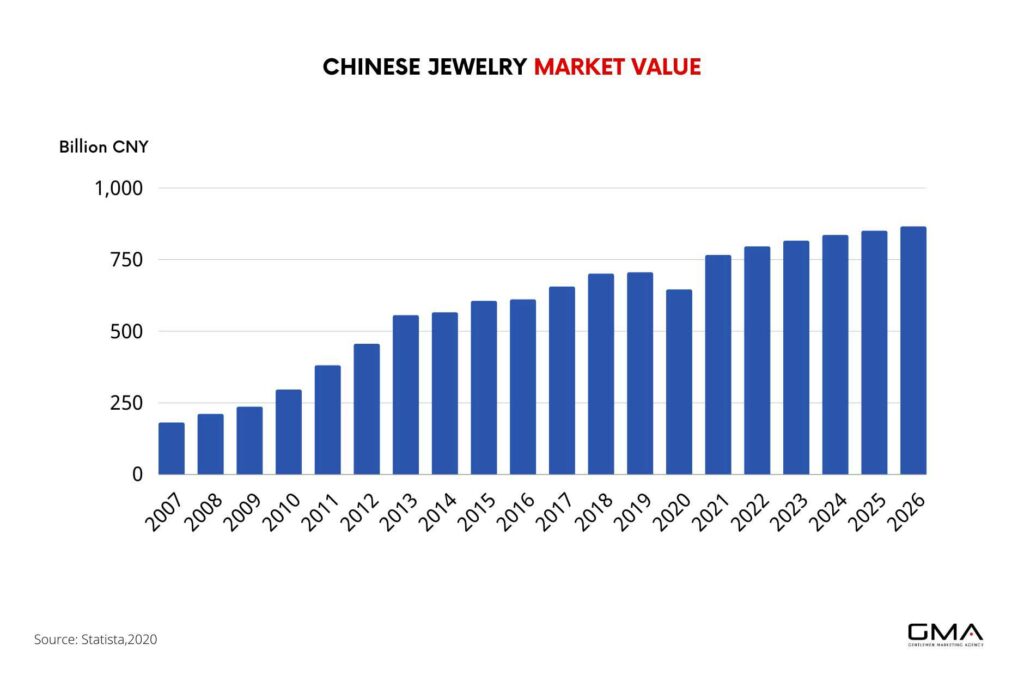

China’s jewellery & watches market

In China, the annual revenue of luxury jewellery and watches should reach almost 24.5 billion USD in 2023. The annual growth is expected to reach 6% and most revenue will be generated in China in the coming year. The opportunities for the luxury jewellery sector are huge.

The market is dominated by luxury giants like Cartier, Chanel, Tiffany & Co, Dior, and Bvlgari. Chinese are sensitive to craftsmanship, material, design, and brand when they look for jewellery. In a word, storytelling is everything when you want to build your jewellery brand in China.

In 2023, the success of gold and diamond among the Chinese is still accurate. In the coming months and years, we should see a soaring success of rose gold over white gold and yellow gold. The new trendsetters are younger consumers and especially post-1980s consumers who contributed to 80% of China’s diamond sales a couple of years ago.

For the coming year, it is important to stand ahead of trends since the market is evolving fast. Luxury jewellery is moving towards a gender-fluid approach. Chinese are looking for diversification and men often complain about the lack of finesse and sophistication in male jewellery. The available items often include rapper chains, cufflinks, belt buckles, and gothic rings.

Luxury watches in China

Chinese have a great taste for materials and are always looking for unique designs. Today, the top brands with higher brand awareness in China are Rolex, Cartier, Omega, Longines, and Bvlgari.

Most Chinese prefer to purchase Swiss luxury watch brands since it is proof of quality for them. Craftmanship, brand, and design are the most important criteria before purchasing a luxury watch. Chinese will always favor a simple everyday watch compared to an overly complicated design with tons of jewels.

In 2023, the keyword for jewellery watches is timeless. Luxury brands need to embrace Chinese preferences for elegance over time. Indeed, 50% of people wear a watch to bring out their personal taste and image. It is not about convenience, but about social status. In such a case, the branding will be as important as the design since brands will need to prove to their Chinese consumers they discover a timeless piece. But in China, timeless does not mean boring.

In the meantime, the Chinese will look for watches that embed Chinese elements in the design or limited edition in partnership with local influencers. The limited-edition L.U.C QF Jubilee proposed by Chopard in April 2021 was only counting 25 models. Such a limited production is key to seducing and engaging with Chinese luxury shoppers who could sell it out in only a couple of minutes.

High-end fragrances & cosmetics

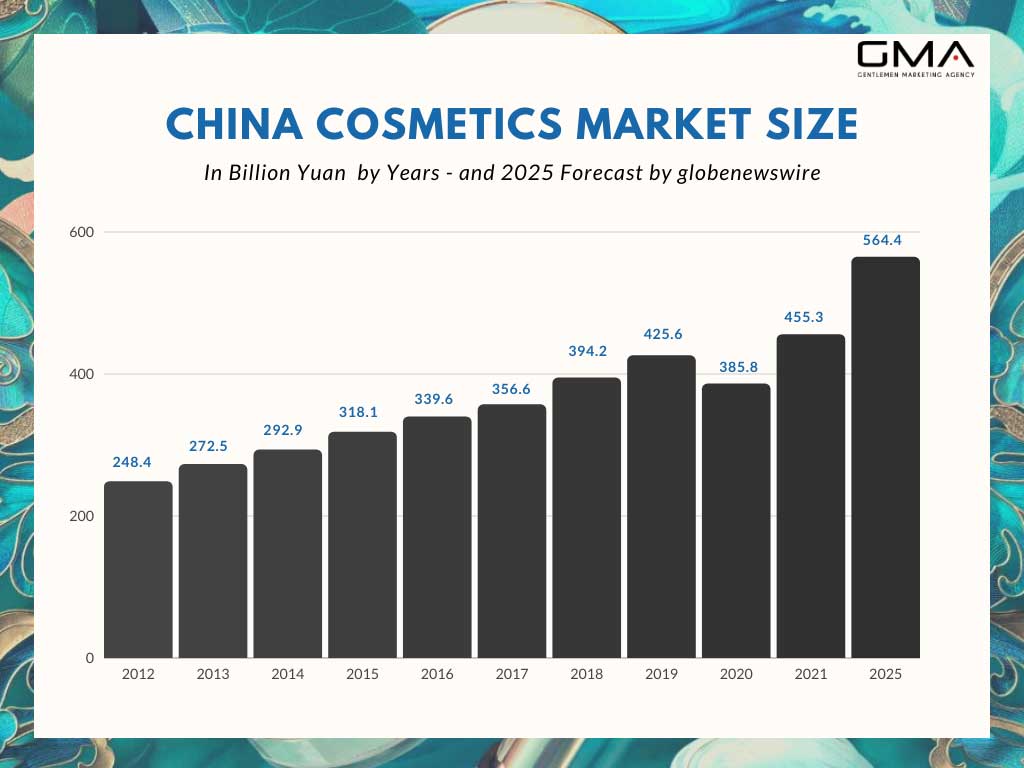

In China, luxury cosmetics and fragrances should reach annual revenue of 8.5 billion USD in 2023. The expected annual growth rate of the category is about 8% for the coming years.

Makeup and skincare are the best-selling categories among cosmetics. For a brand looking for selling opportunities in China, it is necessary to favour floral and light scents. Today, the top best-known cosmetics brands in China are Chanel, Estée Lauder, Dior, Lancôme, and Shiseido. Chinese consumers give importance to effects and ingredients over any other criteria.

In 2023, clean beauty is the leading trend of the market in China. Chinese women are more environmentally and health-conscious. They will avoid animal testing on cosmetics and dirty components. Today, 90% of Chinese expressed the importance to purchase clean or healthy beauty products. It is driven by Millennials and Gen Z who assess the value of plant-based skincare and are more open-minded to international beauty standards.

The same evolution is taking place in the makeup segment since Chinese men are more and more interested in putting some make-up on. The luxury brand Chanel noticed the opportunity and decided to launch the franchise BOY including lotion, cream, eyebrows pencil, mascara, and nail polish. Stay up to date, be bold and dare disruptive campaigns to talk to Chinese consumers. In cosmetics, sustainability and inclusivity are key.

Premium wines & spirits

In China, the spirits market should reach annual revenue of 341.55 billion USD in 2023. For the Chinese, the main wine and spirits brands are Rémy martin, Moutai, Wuliang Yi, Louis XIII, and Hennessy.

The majority of Hong Kong consumers would prefer to purchase premium red wine while Mainland China consumers favour premium whiskey. Chinese will always favour the taste, the brand, and the limited edition before purchasing a wine or spirit bottle. Before purchasing these items, they will look after information and recommendation from friends with similar interests. WeChat private groups are particularly important for Chinese who want to get access to the best-imported wines.

Chinese are more educated about wine-tasting since wine bars or “bar à vins” are opening in Tier Cities 1 and 2. In Hangzhou, you can enter a wine bar to taste different imported wines and participate in special tasting nights. Today, distributors are very tough, and margins are decreasing.

The key is to invest in branding and storytelling. More than ever before, luxury brands share the story of their castle, broadcast videos of founders, and propose beautiful pictures of vineyards. The competition is tough, and brands are even more innovative. Fancy Cellar launched a video game called “Drink different – Drink Smart” to make wine more appealing and fun while educating Chinese consumers.

Luxury cars & yachts

In China, luxury is essential to show off. Having a car or a yacht is a symbol of social status and personal success. In the West, you demonstrate your success by taking cabs or having a personal driver who has his own car. In China, you are successful if you have the financial capacity to purchase your own car, especially a luxury car.

The wealthiest Chinese will purchase their own luxury car and hire a personal driver. Even during the Covid-19 pandemic, luxury vehicles rebounded strongly in China. Local consumers always favour German brands and now turn more and more into luxury electric cars. Work on your branding and create high-quality content to seduce Chinese wealthy men and women.

When it comes to luxury yachts, the market is more problematic. There are no large marina slips in Mainland China, and a lucky owner of a yacht will need to dock it in Hong Kong, Singapore, or Thailand.

The Chinese government restrictions are extremely strict regarding yachts since they created a limitation of 12 people aboard a yacht, including the crew. Basically, the Chinese will face more drawbacks than benefits by acquiring a yacht. Luxury yachts brands who want to target the Chinese should attract them and offer them yachts tours while they travel abroad.

Luxury tourism

When the Chinese are travelling abroad, they tend to favour luxury and upscale hotels. The majority of Chinese do not have sufficient wealth to afford a journey abroad. When Chinese luxury lovers travel abroad, they always book their leisure trips through Ctrip, Qunar, or Booking. Luxury brands who want to market their luxury offer from hotels to trips should definitely invest in Trip promotion and advertising.

In January 2023, China finally reopened after almost 3 years of closed borders. Chinese tourists are slowly coming back, so it’s time to adapt to the new type of travellers. Today, they prefer smaller groups and more personalised trips, having in mind unique experiences and outdoor activities.

How to Market Your Luxury Brand in China

China is evolving fast, which is the biggest challenge for foreign companies. You need to stay up-to-date with trends and innovations if you do not want to be left behind. The moment you decide to enter the Chinese market, a dozen of other premium and top luxury brands have already entered it. So it’s important to do it right!

To sell luxury goods in China there is a need for strong branding

In China when we talk about your “branding” we talk about your brand image. Even if you benefit from small notoriety in your home country or internationally, people in China do not necessarily know who you are. Chinese netizens do not use Google, Facebook, Instagram, or Twitter. They do not have access to your existing content and advertising campaign. Basically, when you want to enter China, you have to start again… from scratch.

To do so, it is essential to have quality content. Chinese are sensitive to premium photography and video. Every day, they get access to tons of high-quality content. Your content definitely needs to be appealing and stand out from the crowd.

We often recommend doing some additional shooting to boost your publications on Chinese social media or on your Chinese website. For leading brands, a step further would be to integrate Chinese and Asian models in your photoshoot to enable the Chinese to identify themselves with your brand.

Localize your marketing campaigns for the Chinese market

The campaign localization is key in China. It is essential to understand the Chinese culture and aesthetics to avoid any “faux pas”. A bad buzz can happen fast in China if you do not play by the rules. It does not mean you have to spread your image out and remove your specificities. It just means you need to know and respect the local values, culture, and expectations.

The most interesting example in last years was given by Burberry. The luxury brand localized well its campaign by creating clothes for the video game Honor of Kings. In brief, these are the most profitable online games of all time, and virtual clothes contribute in a large part to luxury brands’ sales. This strategy is key if you want to target young and wealthy Chinese through the digital world.

Burberry signed a partnership with Tencent to be embodied in Honor of Kings. In the meantime, the brand declared it is no longer using cotton from the Chinese Xinjiang where Uyghurs are and supports the “Better Cotton Initiative”. Burberry learned at its expense that cultural sensitivity also applies to the virtual world. All the clothes from this brand are removed from the online game and Tencent suspended their partnership.

If you know a little about China, you should have noticed that what is happening to Burberry is a double penalty. Why? Because Tencent also owns QQ, WeChat, and Weibo. The leaders of social media and online Q&A in China.

Focus on building a positive e-reputation on the Chinese Internet

When we say that your reputation precedes you, it is even more true in China. It is vital to develop your online reputation on forums, blogs, and Q&A sessions to instil trust among your potential customers. They always go on this type of platform to look for testimonials, references, and topics linked to recommendations.

The main two threats that your brand should fear are having negative comments or no comments. In China, having no existence is as worst as having a bad reputation. And you need to take care of that.

It is essential to work on your community management by posting regular content about your brand and controlling the online comments. You need to post massive positive comments and manage any potential negative comments about your product.

In China, as we mentioned, you will enter the most competitive market in the world and the competition is fierce. Your local competitors will not hesitate to post negative comments or posts about your products to take back their market share. You should better have a local partner to monitor and control your online reputation on a daily basis.

In China, social media are essential to target, reach, and engage with potential customers. You will have tons of possibilities to create interaction and instil a sense of belonging among Chinese who will discover your brand.

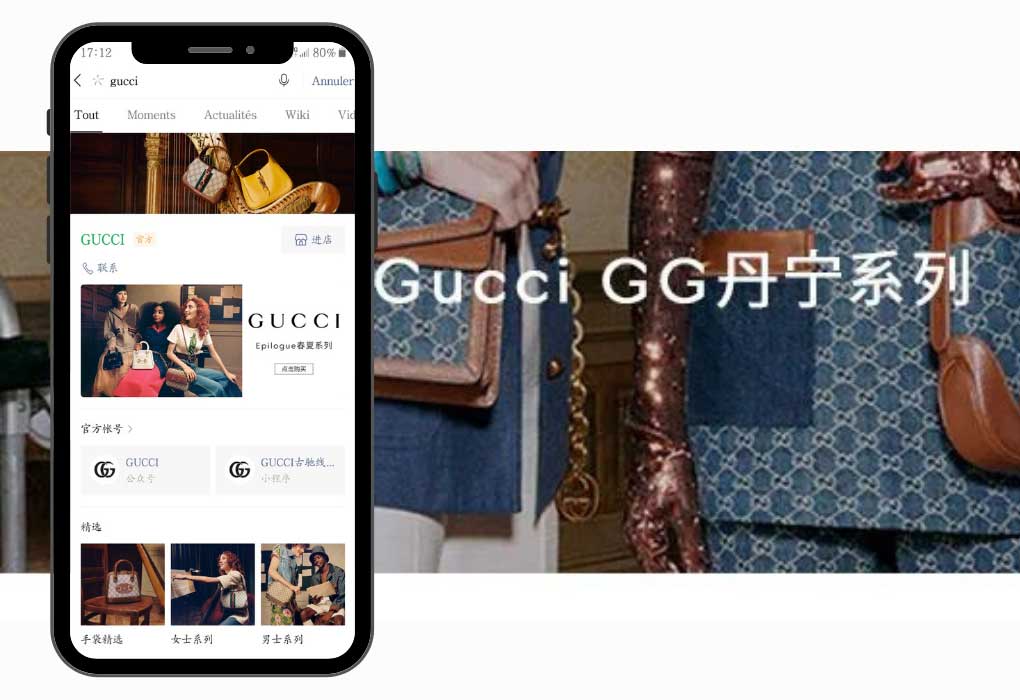

The most popular platforms among luxury shoppers are WeChat, Weibo, Little Red Book, and Douyin. They are at the centre of luxury brands’ marketing strategies to gain visibility and develop a closer relationship with their local followers.

WeChat is a great communication channel for luxury brands in China

With 1.26 billion users, WeChat is the most used social media platform. Every Chinese has a WeChat account. It is key to be and stay connected with everyone: family, friends, colleagues, clients, suppliers, and brands.

For a better understanding, we often compare WeChat to a mix of WhatsApp and Facebook. Basically, the only difference is you can do anything with your WeChat account. You can send messages, have called, pay for products, read news, book train tickets, order a cab, post content, and follow brands.

Compared to other social media, WeChat is a very private social media. For luxury brands, it is key to develop great interactions and a deeper sense of belonging. Why? Because brands need to search for your brand to connect with you and see your content. Every follower you gain on WeChat is gold because they made the decision to search for you and engage with you.

Weibo: perfect for increased visibility

Weibo is the second most used social media in China with 580 monthly active users. Weibo is popular among Chinese Millennials and Gen Z because it is the best place to express themselves. They share their thoughts, pictures, and visions. It is often compared to Facebook and Twitter because people do not fear that much censorship on social media.

This platform is essential for luxury brands not only because they will have freedom of publication but because 82% of Weibo users purchase online. In a word, you will maximize your e-commerce stores or online distributors.

We often recommend the opening of a Weibo official account when you open a Tmall flagship store. It is a great drive-to-store strategy to increase your traffic and sales. The main asset of Weibo after the pandemic is the strong development of live streaming sessions. In 2020, Weibo recorded a +50% increase in live streaming sessions on its platform.

Little Red Book: The Chinese social media luxury fashion and cosmetic brands

Little Red Book is the literal translation of Xiaohongshu. It is considered to be the Chinese Instagram with the regular quality content posted and the influence of key opinion leaders and influencers on the platform. This social media benefits from a lower user base but a better-targeted audience.

On average, there are more than 200 million monthly active users. Among them, 50% are from Generation Z. From what we said previously, Gen Z is the leading force of luxury in China and you definitely need to link into RED if you want to target them effectively.

The other great asset of Little Red Book is the gender user base since more than 80% of the users are women. This information is gold for women’s fashion, cosmetics, and women’s jewellery brands that want to reach Chinese women.

If you want to perform on this social media you need to post quality content, share fans’ posts, engage with KOLs, and open a Little Red Book store. There are tons of results-driven features you need to look into before opening and managing your RED account.

Connect with Gen Z, the main luxury consumers segment on Douyin

Douyin is the first video platform in China. Basically, if you know TikTok you know Douyin since it is only the Chinese given to the same platform. On average there are 800 million monthly active users and 600 million daily active users.

Especially due to the pandemic, short-form video platforms faced immense success among Millennials and Gen Z with even older users in China. The daily active users increased by +200% in only 2 years. This growth is essential to keep in mind when you want to digitally perform in China.

Chinese people always favour short and insightful content over long-form videos. They watch videos during transportation or while they are waiting in line. Brands decided to take advantage of these habits to target the Chinese with dense short-form videos that will remain in people’s minds.

Luxury brands benefit from the double asset of promoting their products easily and making them accessible to their audience. In March 2021, Douyin launched store features to enable brands to open their own stores on social media. More than 220 brands are already registered including the premium cosmetics brand Perfect Diary.

Luxury brands should collaborate with Chinese KOLs

Key Opinion Leaders (KOLs) are extremely important in China. They set trends and drive traffic to brands’ stores. Fashion, cosmetics, and jewellery are the two main categories in which KOLs will have the highest level of influence. But in any category, you will have your own leading KOL who has the power to increase your conversion rate and double your sales within minutes.

For the bags and leather goods, you definitely need to link into Mr Bags who generated 460K USD in only 6 minutes for the brand Tods. For cosmetics, you need to take a look at Lipstick King, who can try 380 lipstick shades during a live streaming session and can decide whether a shade will be sold out or a bad buzz.

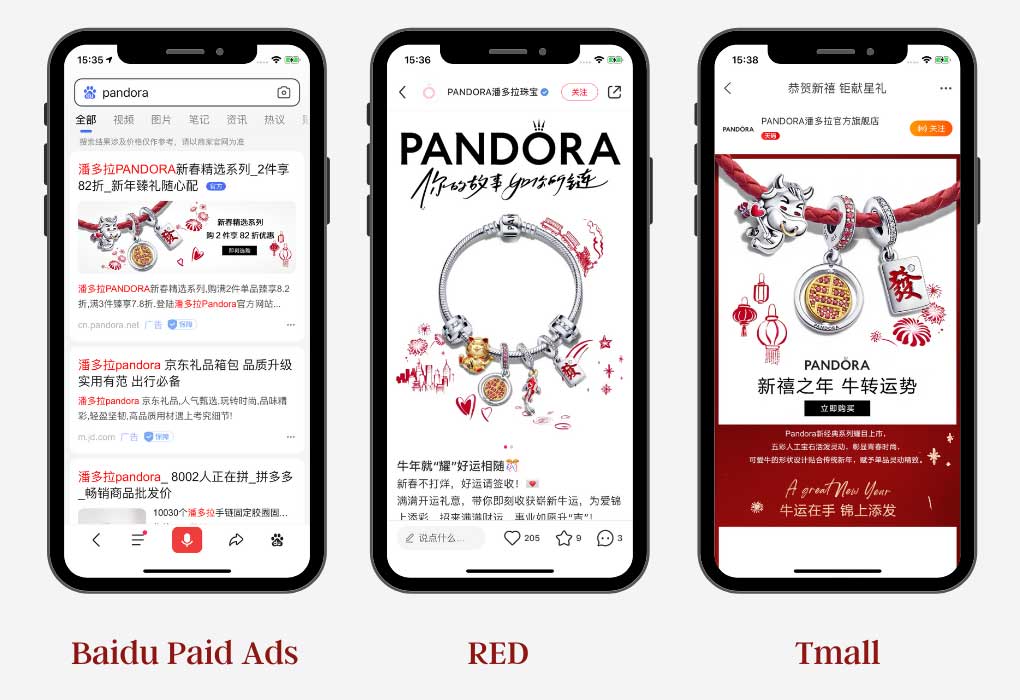

By order of importance, Weibo, Little Red Book, Douyin, and WeChat are the key social media platforms for KOL endorsement. 60% of Chinese go on Weibo to obtain recommendations from KOLs or bloggers. If you want to reach a wider audience and increase your conversion rate, you definitely need to invest in KOL or KOC. From small influencers to celebrities, you can give a unique aura to your brand in China.

Luxury and e-commerce are tightly linked in China

In China, e-commerce is the quintessence of business. If you have ambition for your brand, you definitely need to open a store on e-commerce platforms like Tmall or Jingdong to generate higher sales. These two platforms only accept high-quality brands with a good image and a positive reputation.

In China, the e-commerce decision is not only yours, but platforms will also decide whether they want to sell your products and make you appear on their website. If you want to get ahead, you need to show sales opportunities and the brand’s success.

Tmall & Tmall Luxury Pavillion

Tmall is the first go-to e-commerce platform for luxury brands in China. This is the most performant platform for luxury and premium brands that want to offer a unique consumer experience through digital features.

There are 780 million consumers in China who purchase through Tmall, and the number of new overseas brands joining Tmall Global increased by 64% year on year in 2020. All the luxury and international brands get to know this e-commerce leader and do not want to miss the opportunity to generate tons of sales, especially for key shopping dates like Chinese New Year or 11.11.

Brands have access to Tmall, Tmall Global, and even Tmall Luxury Pavilion. This pavilion is an “app within an app” that enables top selected clients to get access to the most premium and luxury brands with dedicated flagship stores and unique experiences including AI and AR. For instance, Estée Lauder used Augmented Reality (AR) on Tmall and the Chinese spent 70 seconds instead of 30 seconds on their product pages per visit.

Tmall is key for luxury brands who have ambition in the Chinese market. With strong branding and advertising, you can generate millions of sales and level up your brand.

JD.com welcomes luxury and high-end brands

Luxury brands also use Jingdong or JD.com since it is the most trustworthy e-commerce platform in China. On average, luxury brands will be available on Tmall only or on Tmall and JD depending on their size and marketing strategy.

Compared to Tmall, JD is more pertinent for brands’ in-home appliances and technology devices. The luxury brands like Prada that decided to go along with JD in addition to Tmall are playing an “image strategy” rather than a “sales strategy”. They want to show their striking force on the Chinese market by taking over all the e-commerce platforms of the country.

If you want to enter JD, you will also have to prove your brand awareness and potential sales in China. You will manage your store and advertise with key drive-to-store strategies.

China is a complex ecosystem mixing word-of-mouth, reputation, social media, influence, and e-commerce. If you want to enter the first market in the world, you need to be prepared. To do so, you need to build a local team in China to help you through all these operations or select the local agency with the most expertise and results.

About us: The Best Mareting Agency for Luxury Brands in China

Finding the right partner before entering China is key. We are a specialist agency with almost 10 years of experience in the development of fashion and luxury brands in China. We worked with a lot of international brands to help them build their brand, develop their audience, and double their sales. At Gentlemen Marketing Agency, we fight for cost-effective strategies to achieve great results.

How can we help you grow your Luxury Brand in China?

Our focus is to promote your brand with your target and objectives closely in mind. We will hold several meetings with you to understand your history and potential for the Chinese market. Then, we will manage the campaign and assure its optimization and success. In a word, you have found your local partner to achieve your growth in China.

An International Team

We are a team of Chinese and foreign experts passionate about digital and China. Each member of the team is specialized in a field (design, web development, business analyst, etc.) with a long experience and proven efficiency. We benefit from a multicultural background. This is our key success factor: we understand the Chinese culture and consumers while we respect your international brand DNA.

An ROI focused Agency

The commitment to success and results is essential. We are a results-oriented agency, which means we thrive for success. We are committed to the results we will achieve for you in the most competitive, dynamic, and challenging market in the world. The solution is to seduce, attract, and re-target the most qualified audience for your brand to increase your conversion rate.

Professionals of Branding & eCommerce in China

We are professionals in branding and e-commerce. We guide you through your journey in China by taking care of all your operations: website, social media, community management, KOL, PR, undercover marketing, e-commerce setup, customer service, etc. In a word, you are not our client but our partner. We always build long-term relationships to achieve success.

Bonus…

We are a friendly team, we offer coffee if you book a meeting with our consultants to discuss your project in China. We have already worked on fashion, jewelry, watch, wine, and tons of luxury projects. If you’re interested in being part of the Chinese market and want to reach your Chinese target, you need to adopt the most intelligent strategy.

Our luxury division is directed by an LVMH former talent. She worked for the two luxury Houses of Givenchy and Guerlain and will provide you with the best insights on luxury strategy and operations to implement. Our dedicated team can offer a China digital strategy adapted to your brand universe, products, and target. Don’t hesitate to reach out for more information.

Are you ambitious enough to enter the first market in the world for luxury? We can help you achieve your goal!

Over the years we’ve worked with many luxury brands, introducing them to the world’s largest luxury goods market and making their brands grow. We provide many services that are suitable for companies of all industries.

If you’re interested in getting to know your possibilities on the Chinese market, leave us a comment or contact us to discuss your project!

10 comments

nick

Would marketing custom motorcycles in china be a profitable venture?

Iga

Hello! It’s definitely something that might work out in China, would you like to talk to one of our experts about your options?

John

Would working with Chinese Kols be worth it to promote a brand if prenium whisky in China or would a more traditionnal approch through chinese distributors be wiser?

Dolores Admin

Yes, it would be worth it, if you are able to find the right KOL that specializes in the premium alcoholic beverage and has a following of premium whisky lovers.

You would likely have to go for a more niche KOL or even KOC (Key opinion consumers). If your budget allows it, you could have one of the big-name endorse your brands, but we would not suggest you go on that road when getting started in China. Build your brand a name first through KOC and Forums, reach out to your niche target audience, and later when your reputation is solid, feel free to reach out to that bigger KOLs and why not have fun with live-streaming and touch new consumers.

As to the second part of your questions, the two are not exclusive. You can, and should be working on your marketing even if you already have Chinese distributors backing you up. Even if everything goes well with your Chinese partner, your marketing effort will most definitely with increasing your sales.

On top of that, if you decide, that after your contract is over with your Chinese distributors, you’d rather go with direct selling route through eCommerce for instance, you won’t have to start from scratch and get to register on a platform like Tmall will be much easier because your brand is already well known and trusted on the market.

zovrelioptor

I have not checked in here for some time because I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

Carlatun

What is possibly the biggest reason for brands to be cautious about seeking a one-on-one partnership with a Chinese fashion blogger is the unclear relationship between sales and influencer marketing. After Gogoboi s November Fendi campaign, the brand’s parent company LVMH reported in its 2016 annual report that Fendi saw sales growth in China’s market. The two events may be correlated, but such correlation does not imply causation.

Bernard Richards

Thank you for sharing this very informative report about the China market. This is important to understand the global luxury market trends.

B.R.M Chronographs is an independent SME French luxury watch brand that started with my passion for karting and mechanical precision. I am looking for a trusted somebody who is serious and open to understanding my Brand’s vision and DNA but it is not easy to find someone who bilingual in Chinese/French and really knows the China LUXURY market specially bespoke timepieces like my brand. All our products are handcrafted in our workshop located in the suburbs of Paris, France. B.R.M is the only watch manufacture in the Regional Nature Park of French Vexin. I am open to any propositions of collaboration or partnership.

Bernard

Nimi Nanji Simard

A terrific and helpful article, thank you! I think you’ve saved me some consulting fees!!!

Nimi Nanji-Simard

Founder & Chief Scarf Lover

NimiNimi Designs

Olivier VEROT

You are welcomed 🙂

Mike

very complete article.

Great job GMA.

Congrats.