The Chinese Luxury Market is now one of the biggest in the world. According to Bain & Company, Chinese luxury consumers will account for around 50% of global luxury consumption in 2025. With burgeoning levels of wealth and disposable income, expectations from Chinese consumers are diversifying.

The middle class is growing and so is the will of Chinese people to spoil themselves and spend money on luxury goods and services. But the Chinese luxury goods market is a demanding one and the competition is growing, as domestic luxury brands are joining the table. In this blog post, we will see what is the best way for foreign brands to reach out to Chinese shoppers and sell luxury goods in Mainland China.

Actionable GMA tips for New Luxury Brands in China

New Brands aiming to establish a strong presence in China’s luxury market must adapt to the unique communication landscape and consumer expectations. Here are five tips for luxury brand communication in China, each accompanied by an elegant quote and relevant brand references to illustrate these strategies:

- Leverage Key Opinion Leaders (KOLs):

- “Influence is not about elevating self, but about lifting others.” – Sheri Dew

- Example: Brands like Gucci and Chanel have effectively used KOLs to reach affluent audiences. These KOLs, often celebrities or well-known fashion influencers, create aspirational content that resonates with their followers, amplifying brand prestige and desirability.

- Engage on Douyin for Visual Impact:

- “A picture is a poem without words.” – Horace

- Example: Burberry has utilized Douyin by creating visually stunning short videos that showcase their latest collections through artistic storytelling, thus engaging a younger, tech-savvy demographic that appreciates both luxury and creativity.

- Host Interactive Live Shows:

- “The art of communication is the language of leadership.” – James Humes

- Louis Vuitton has embraced live shows on platforms like Douyin and Weibo, where they not only showcase products but also engage directly with consumers through real-time interactions, offering a personalized shopping experience that enhances brand loyalty.

- Master RED (Xiaohongshu) for Community Engagement:

- “Engaging the hearts, minds, and hands of talent is the most sustainable source of competitive advantage.” – Greg Harris

- Dior effectively uses RED, a social media platform that combines lifestyle blogging with e-commerce, to inspire and engage with a community interested in fashion, beauty, and luxury lifestyle. They encourage users to share their own content related to Dior products, fostering a participatory brand culture.

- Develop Content That Resonates with Cultural Preferences:

- “Culture eats strategy for breakfast.” – Peter Drucker

- Burberry has tailored its content to reflect Chinese aesthetics and cultural elements, resonating deeply with local values and tastes. By integrating elements of Chinese art and culture into their campaigns, they create a sense of cultural respect and relevance that appeals to Chinese luxury consumers.

Luxury brands can cultivate a strong presence in China, engaging sophisticated consumers through culturally nuanced, digitally savvy, and visually appealing communication approaches.

Can you succeed for a luxury brands without Marketing ?

No. it never has been done

Little Red Book, the Chinese instagram favorite social media for Luxury brands 2024

Little Red Book, also known as Xiaohongshu, is a crucial platform for luxury brands aiming to succeed in the Chinese market for several reasons.

key factors that underscore its importance:

- Targeted Consumer Base: Little Red Book has a predominantly young, urban, and predominantly female user base that is highly interested in luxury goods, beauty products, and lifestyle trends. These consumers are trend-sensitive and have considerable spending power, making them an ideal audience for luxury brands.

- Authentic User-Generated Content: The platform is known for its genuine user-generated content and reviews, which lend credibility and authenticity. Luxury brands benefit greatly from this environment as consumers often trust peer recommendations over traditional advertising. When users share positive experiences with luxury products, it bolsters the brand’s image and appeal.

- Seamless Blend of Content and Commerce: Little Red Book uniquely combines social media and e-commerce functionalities, allowing users to post content and directly link to product pages where viewers can make purchases. This integration makes it an effective sales tool for luxury brands, facilitating a smooth transition from discovery to purchase.

- Influencer Collaborations and KOLs: Collaborating with Key Opinion Leaders (KOLs) on Little Red Book can significantly amplify a brand’s reach and influence. KOLs can create aspirational content that resonates with their followers, driving both brand awareness and conversions through their trusted endorsements.

- Market Insights and Consumer Feedback: The platform provides valuable insights into consumer preferences and behaviors. Brands can monitor feedback and discussions about their products, gaining real-time insights into market trends and consumer expectations. This data is invaluable for adapting marketing strategies, product offerings, and customer service practices to better meet the needs of Chinese consumers.

Overview of the luxury sector in China 2024

China is the greatest place for luxury brands, as Chinese consumers are craving luxury goods, checking the trendiest brands and products in the West. In China, luxury shopping is considered a lifestyle, and many Chinese with a growing purchasing power want to spend money on luxury items and services, to show off their wealth.

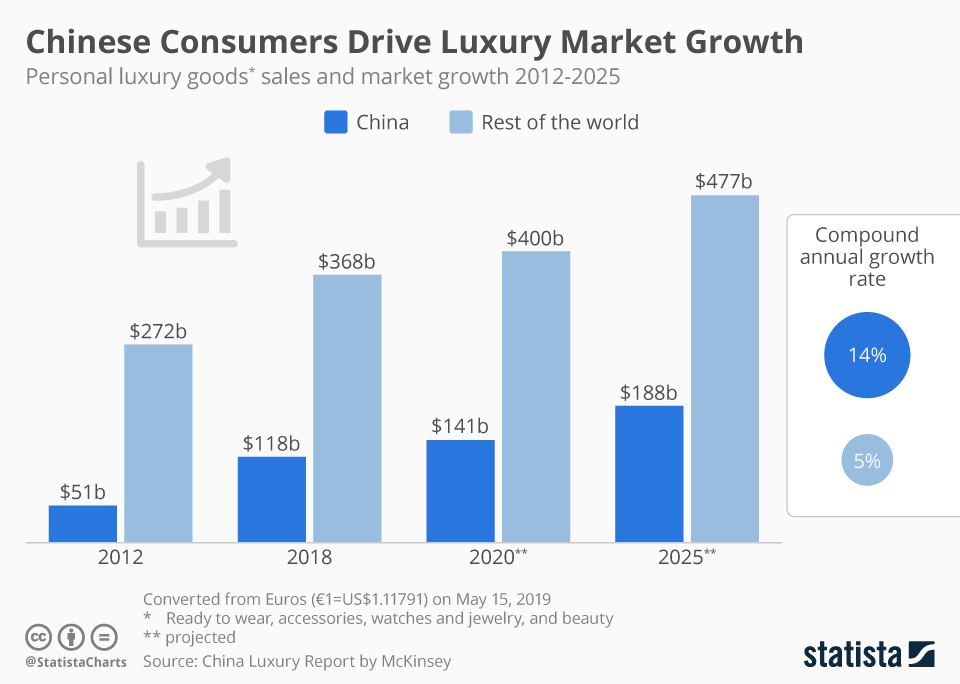

As you can see on the chart from Statista above, the Chinese luxury market is registering tremendous growth over recent years and is predicted to account for 188 billion dollars in 2025. Although the COVID-19 pandemic slowed China’s economy, China is still aiming to be the world’s largest luxury market, with many new customers joining the sector, as their incomes are growing significantly.

Although the Chinese government is trying to mitigate ostentatious displays of wealth and does everything to convince people to buy from local brands (you can check the latest Guochao trend), consumers are still seeking luxury goods from foreign brands. The difference is, is that apart from competing with top luxury brands around the world, companies now also need to compete with emerging local players.

Who are Chinese luxury consumers? Understand your audience

The number of Chinese consumers that chose luxury products and can afford them is growing. Many luxury shoppers come from China’s growing middle class, which is expected to reach 75% by 2030. One of the most important things luxury brands need to consider is offering affordable luxury goods, that will be attractive to these newcomers to the luxury market in China.

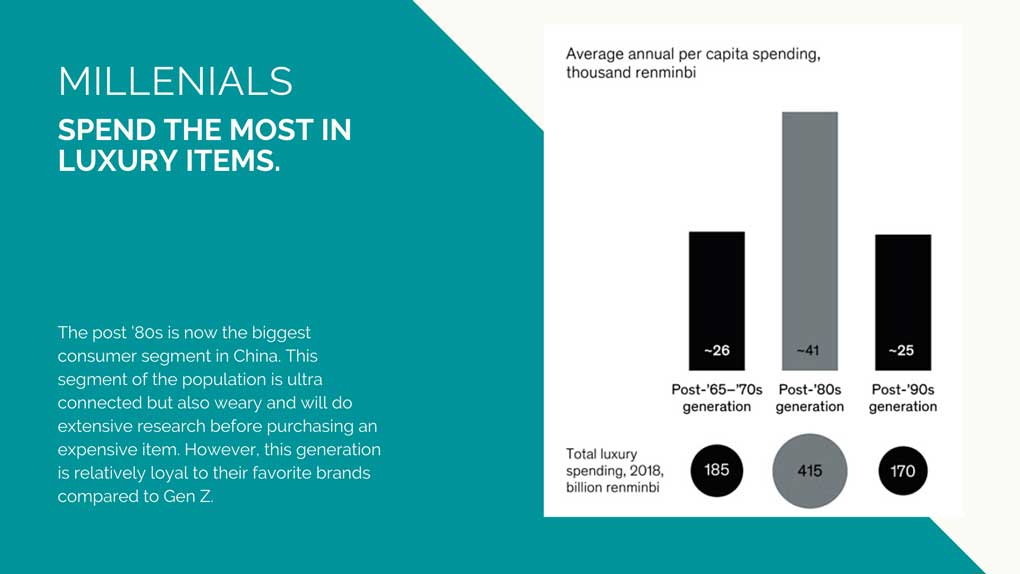

Millennials are the biggest drivers of the global luxury market

The biggest groups of luxury shoppers are Millennials. According to a recent survey, they should account for 40% of global luxury sales in 2024. They represent the largest Chinese consumer group with over 350 million people. Those people go for fashion and jewelry, but they actually help all kinds of industries grow. It’s predicted that they will also be the main driving force of the baby market, so all companies selling toys, skincare products and luxury items for kids have a chance on the market.

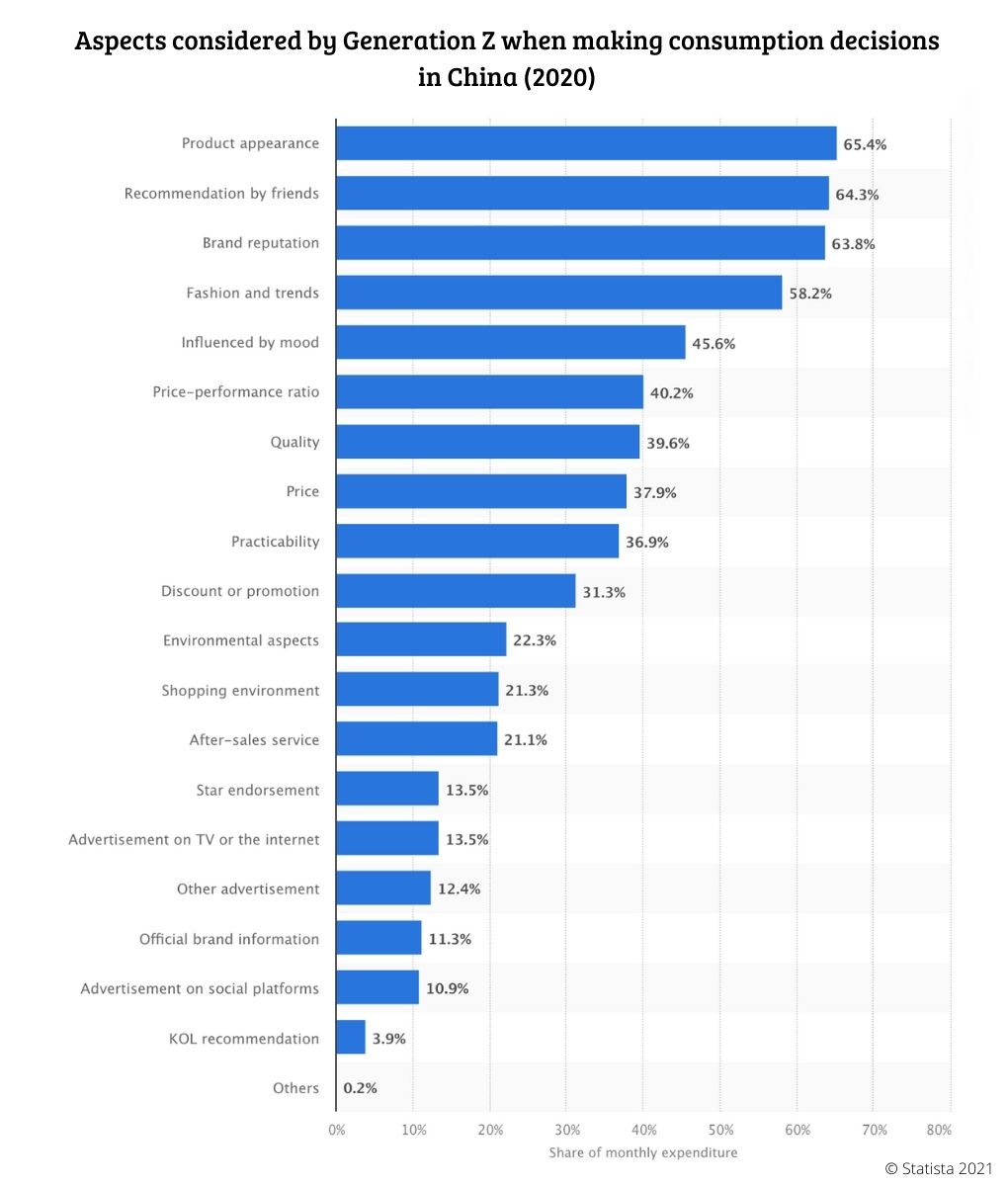

Gen Z is next in line

Gen Z is the generation most open to new trends, but they are also the least loyal to brands, looking rather for quality and experience, rather than logos and names. They have different shopping habits than other generations, and they also use different online channels, like Douyin and Xiaohongshu, so you need to be familiar with those if you want to seduce Gen Z. According to McKinsey, the Chinese Gen Z will account for 20% of the total spending growth in China by 2030.

Chinese Gen Z is also more aware of the climate, and environment, they are the first to embrace sustainable fashion, protesting against animal testing and the negative impact of some products on the environment and their health. They are looking to improve the quality of their lives, by buying good quality luxury goods, taking care of their diet, doing sports, and using natural cosmetics.

Chinese independent women

According to customer data in China, women are spending more than ever before (Their annual spending is expected to rise from RMB3.3 trillion in 2017 to RMB8.6 trillion by 2022). They have a high education, and they decide not to have kids and focus on careers, so they earn a lot of money that they are willing to spend on themselves.

Chinese independent women are particularly sensitive to brand reputation and storytelling. Their shopping habits are very similar; they go through social media, recommendations from the community, discussions with friends, content, and products comparison to motivate their purchases.

How to enter China’s luxury market?

The Chinese backlash against local fakes and counterfeits is one of the reasons international luxury offerings are thriving in China. To be a ‘foreign brand’ has become a byword for quality, thus lending itself to such luxury branding and marketing. It’s important to be aware of this context as it also heightens the importance of an intelligent branding strategy on the most effective, targeted platforms to high-net-worth individuals.

Targeted Visibility & Reputation are a luxury brand’s greatest asset

Targeted visibility & reputation are a luxury brand’s greatest asset in a ‘digital-centric’ market. As a luxury brand, you need to build this strong brand reputation by focusing on particular platforms and communities.

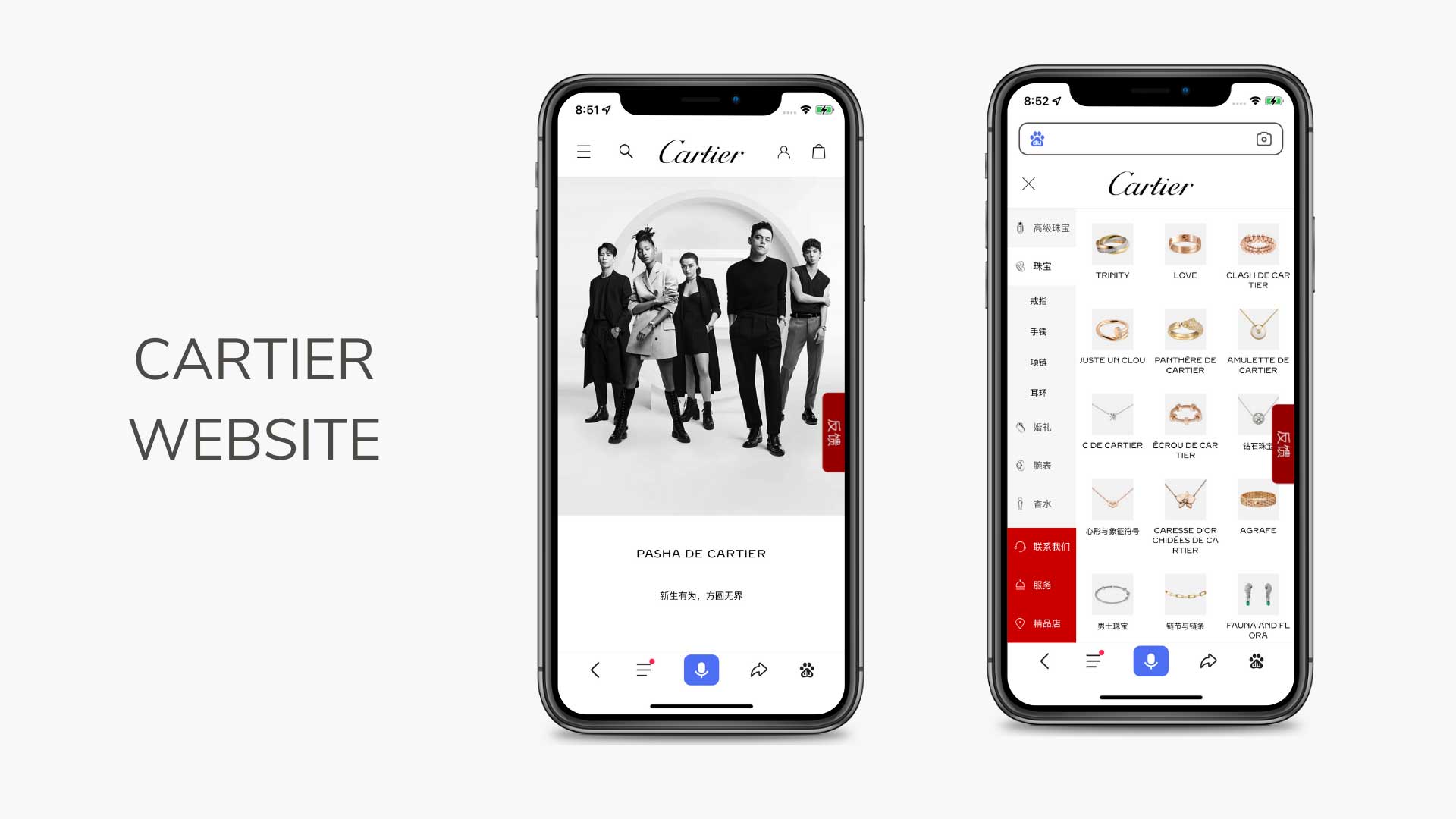

A quality website in Mandarin visible on Baidu

It’s not as simple as it sounds to build a great website in China. Avoid the typical Chinese web formats and opt for a sleek, clean-cut aesthetic akin to your pre-existing site. You cannot simply just create a bi-lingual Chinese add-on as it is best to host the site on a local server with a .cn domain. This involves building the site locally, in addition when it comes to visibility on Baidu (China’s Google), the sites need to be a ‘vehicle for visibility’, that is optimized for Mandarin keyword searches. 75% of all online research is conducted via Baidu.

Content should also be re-adapted for this market with local search terms and keywords in mind, this allows you to place your content in front of the most qualified search traffic in the luxury sphere.

Leverage Baidu’s ecosystem to build brands’ reputation

Chinese consumers are extraordinarily active on forums. In Western digital markets they are old news, but in China remain a powerful way of influencing sentiment & building a positive reputation. There are a host of platforms to consider, with the most important being Baidu Zhidao, Baidu Tieba, Zhihu, & Tianya. Consumers are active in threads devoted to luxury products, they will share recommendations, images, shopping experiences, and thoughts on brands.

From exposure on such forums links to those on Baidu, forums rank highly in the search results so it’s vital to cultivate a positive reputation here. Comments, posts & discussions will be seen.

Social media platforms presence is essential when it comes to Chinese luxury consumers

In China, social media are essential for luxury brands because this is where most of the recognition and word-of-mouth marketing comes from. They allow you to promote your brand, engage with potential consumers, follow the trends, and attract the audience with influencer collaborations and interesting content. The most popular platforms among luxury shoppers are WeChat, Weibo, Little Red Book, and Douyin.

WeChat now boasts over 1.356 billion monthly active users, a new record for China’s number-one social tool. WeChat is a ‘swiss army knife’ for brands when it comes to pushing content, branding, and engaging with followers.

Data 2024

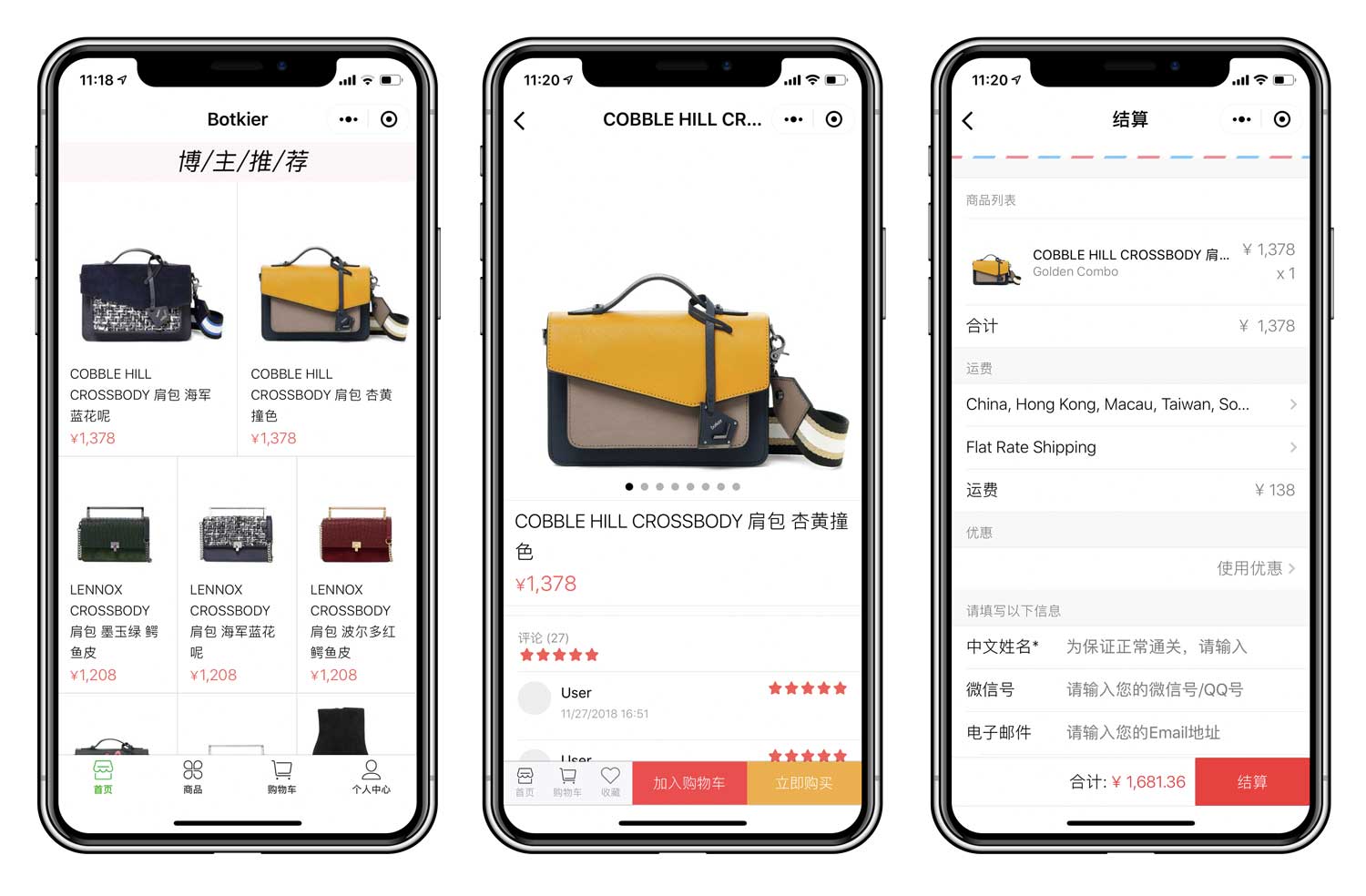

Wechat allows brands to create Official Accounts, where they can post news and promotional materials and keep in touch with their audience. Apart from that, brands can create mini-programs within the app, where they can show their brand and products in an H5 Brochure, which is an interactive way for companies to present their brands.

On top of that, there is also a possibility to use WeChat as an e-commerce platform, by creating a WeChat Store. In fact, more than 95% of brands available on WeChat have their own stores in the app.

Use Weibo: “China’s Twitter”

Weibo is China’s most ‘open social network’, users can see posts from anyone and do not have to be connected first. Weibo is akin to Twitter, it’s a microblog so focus on short posts, and pages can once again be customized with branded content as a backdrop.

On Weibo, you can promote sales by re-posting consumers’ comments, or by collaborating with influencers, organizing discounts, and so on.

Xiaohongshu is the best app for luxury shoppers

Xiaohongshu is a social e-commerce platform, originally created to allow users to share experiences about products/services bought abroad. Xiaohongshu targets Millennial women from first to third tiers cities, interested in luxury foreign brands. It is, therefore, a very useful platform for high-end/luxury brands that is willing to launch their products on the Chinese market.

Moreover, the main advantage of it is that it lays on UGC (user-generated content) meaning that this platform is considered a very reliable platform for getting information prior to purchasing a product.

Key Opinion Leaders (KOL’s)

KOLs, which are Chinese influencers, are all the rage currently, and for good reason. They offer a powerful infrastructure for luxury to reach Chinese consumers. The key is to target the right KOLs that reach the high-net-worth demographic, it’s a case of focused exposure.

Key Opinion Leaders are usually specialists in their niche markets, like skincare, jewelry, parenting, fashion, etc. They can help you reach a bigger audience for your products while working as ‘word-of-mouth’ marketing, convincing their followers about products they use by posting photos, and videos or engaging in live-streaming sessions.

Key Opinion Leaders are the best marketing tool when it comes to luxury goods, especially when targeting Millennials and Gen Z.

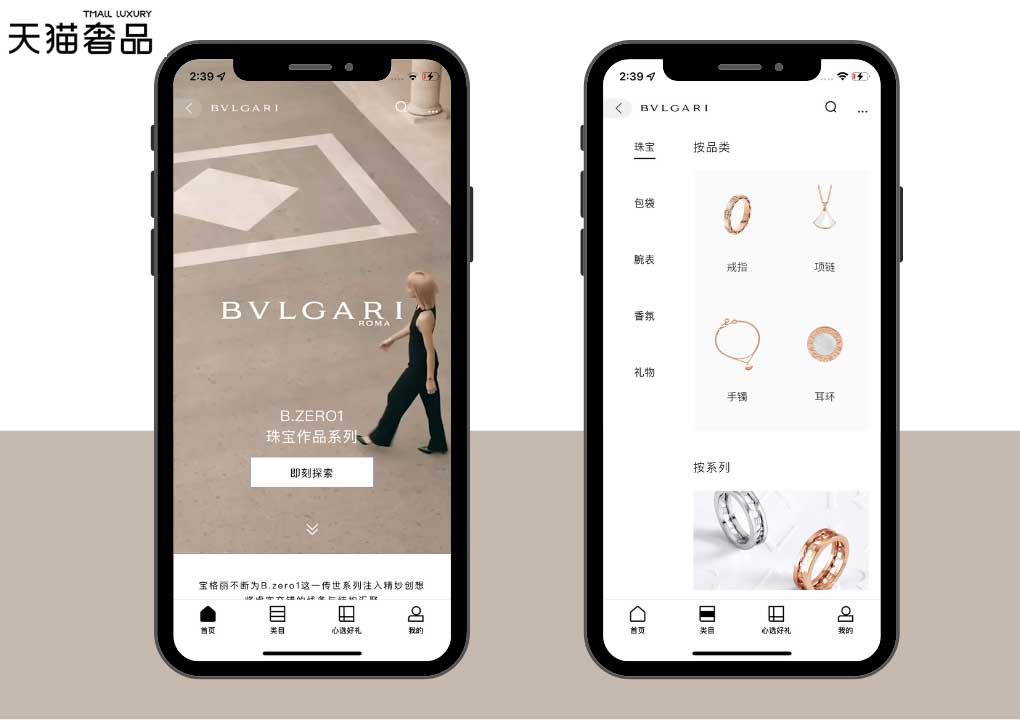

Cross Border E-Commerce For Luxury Brands

Alibaba’s flagship e-commerce platform Tmall is reserved only the for most successful players, 85% of brands are rejected from Tmall, Why? Because Tmall tends to select brands that already have a large following, a strong image, a reputation, and significant sales evidence from China. Jingdong (JD) is not dissimilar to a strict application procedure.

The end goal for luxury is to open e-commerce online stores on Tmall & JD as these are the most reputable cross-border platforms. The budget must also be in place for the more expensive setup and associated costs, as well as offline stores in the future, which is usually the biggest challenge.

The alternative route for new luxury products in China is to build up to these largest e-commerce displays on more niche, yet highly valued e-commerce platforms such as WeChat Stores, Little Red Book, Hupu, T Global E-Luxury & more.

In addition, you can follow the following steps to start selling online without such a huge outlay that still yields a significant return on investment. Validation of your luxury concept in this marketplace should be a priority.

Need help entering China’s luxury market?

Contact us!

It’s important to understand your target consumer and how they behave online in a very different digital sphere. Online sales are the priority however click-through rates, impressions, and views all amount to establishing a brand that can sell well to local consumers, this does not happen overnight & requires intelligent strategy.

We are a China marketing agency with over 10 years of experience. We worked with many luxury brands over the years, so we have the experience and specific know-how needed in the industry.

GMA

We help companies wishing to sell on the Chinese market. We are specialists in:

E-REPUTATION: Primordial before launching, we work together on your unique selling point, then on the social networks, and with the help of PR, we make sure that your image on the networks is totally clean and reliable for the Chinese users.

Website – Search: The optimization of your referencing will be essential, our team of specialists will take care of your e-reputation, and the management of your social networks while setting up an SEO / SEM campaign allowing you to gain places in the ranking of the Baidu Chinese search engine and wechat search

ECOMMERCE: Our teams are professionals in ecommerce. To optimize it, your e-reputation must be irreproachable. Investing in online advertising and creating quality content will help you develop your e-commerce.

DIGITAL SOLUTIONS: Website creation, development, and audit; social media marketing (including WeChat & Weibo); PR; monthly reports and analyses by our team of experts.

7 comments

John

Hi

Good article. Shanghai is the best place for luxury brands, tourists and brand exposure

For sales… usually other smaller cities are more profitable

Philip Chen

a good video, interesting to check about luxury packaging

https://www.linkedin.com/posts/philip-chen-809b86137_china-packagingdesign-packaging-activity-7068973954144624640-lDIb

Happy to connect on Linkedin

Jim marshall

Hi we are interested in selling to the Chinese market, we see 1000s of Chinese nationals flying in to the UK to buy luxury goods from London and Bicester Boutiques, we have the knowledge and experience to reduce their costs and increase their margins considerably by using our service, they could half their costs, instead of flying in they can order from home, we will collect and send for a small percentage on each item and send them directly from the Uk to them in China, all genuine high end luxury brands discounted – Gucci Dior Prada YSL Chanel etc, we can do this but don’t know where to start or how to market this to traders and individuals in China so any assistance and advice would be welcomed thanks Jim

Tobi

I need contacts of luxury goods sellers

Matthew

What are the Top Luxury Brand for Chinese Buyers?

Richard

The business of luxury brands in China is not dead, and still Growthing. Luxury Brands have to be more sparter and be more active.

Bruno

how to start selling on wechat luxury good ?

Do you have an article about that ?